All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Give up durations usually last three to 10 years. Since MYGA prices change daily, RetireGuide and its companions upgrade the following tables below regularly. It's important to examine back for the most recent details.

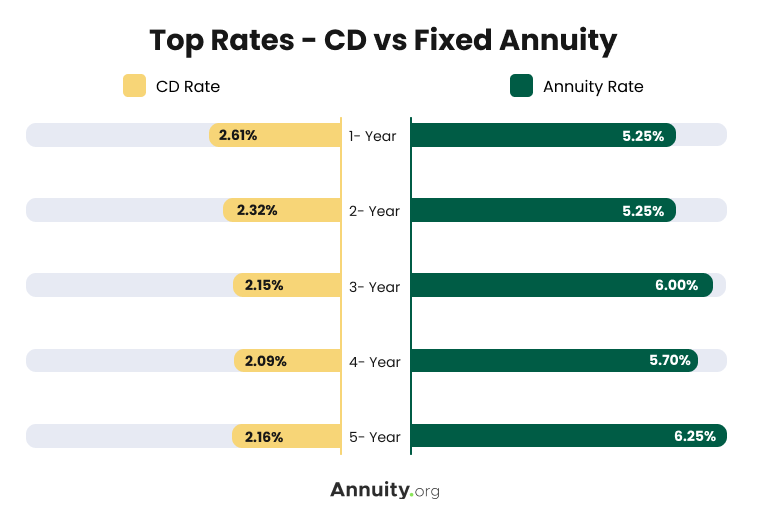

Several aspects establish the price you'll obtain on an annuity. Annuity rates have a tendency to be higher when the general degree of all rates of interest is greater. When looking for taken care of annuity prices, you could find it useful to compare prices to certifications of deposit (CDs), an additional popular choice for safe, reliable development.

In basic, set annuity rates surpass the rates for CDs of a similar term. Besides earning a greater price, a repaired annuity might provide far better returns than a CD due to the fact that annuities have the advantage of tax-deferred growth. This implies you won't pay taxes on the passion made till you start obtaining settlements from the annuity, unlike CD rate of interest, which is counted as taxed earnings each year it's made.

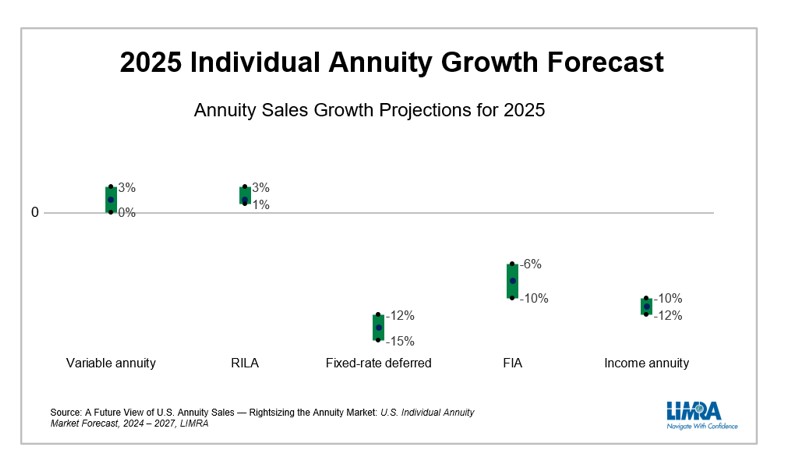

This led numerous specialists to believe that the Fed would reduce rates in 2024. At a policy forum in April 2024, Federal Reserve chair Jerome Powell suggested that prices might not come down for some time. Powell said that the Fed isn't certain when rates of interest cuts might happen, as inflation has yet to fall to the Fed's benchmark of 2%.

Annuity Formular

Keep in mind that the finest annuity prices today may be various tomorrow. It's essential to get in touch with insurance business to confirm their details rates. Start with a complimentary annuity consultation to learn exactly how annuities can assist fund your retirement.: Clicking will take you to our companion Annuity.org. When comparing annuity rates, it is essential to conduct your very own research and not entirely choose an annuity just for its high rate.

Consider the type of annuity. A 4-year set annuity might have a greater price than a 10-year multi-year guaranteed annuity (MYGA).

The guarantee on an annuity is just as great as the firm that issues it. If the firm you buy your annuity from goes damaged or bust, you could lose cash.

Annuity revenue rises with the age of the buyer due to the fact that the revenue will certainly be paid in fewer years, according to the Social Protection Management. Don't be shocked if your price is higher or lower than another person's, even if it coincides item. Annuity prices are simply one variable to consider when getting an annuity.

Recognize the fees you'll need to pay to provide your annuity and if you need to pay it out. Paying out can cost as much as 10% of the value of your annuity, according to the Wisconsin Workplace of the Commissioner of Insurance. On the various other hand, administrative charges can accumulate in time.

Buy The Best Annuity Plan In 2025 - Retirement

Rising cost of living Inflation can eat up your annuity's value over time. You can consider an inflation-adjusted annuity that boosts the payments over time.

Check today's lists of the very best Multi-year Surefire Annuities - MYGAs (updated Thursday, 2025-03-06). These checklists are arranged by the surrender fee period. We modify these checklists daily and there are regular adjustments. Please bookmark this page and return to it frequently. For expert aid with multi-year assured annuities call 800-872-6684 or click a 'Get My Quote' switch beside any kind of annuity in these lists.

Delayed annuities permit an amount to be withdrawn penalty-free. Deferred annuities commonly permit either penalty-free withdrawals of your made interest, or penalty-free withdrawals of 10% of your agreement worth each year.

The earlier in the annuity period, the greater the charge percent, referred to as surrender fees. That's one reason it's ideal to stick with the annuity, when you commit to it. You can take out whatever to reinvest it, yet before you do, make certain that you'll still come out on leading that way, even after you figure in the surrender charge.

The abandonment cost might be as high as 10% if you surrender your agreement in the first year. A surrender cost would be charged to any withdrawal greater than the penalty-free quantity enabled by your delayed annuity agreement.

You can set up "methodical withdrawals" from your annuity. Your other choice is to "annuitize" your deferred annuity.

Crisis Waiver Annuity

This opens up a range of payout alternatives, such as income over a solitary lifetime, joint lifetime, or for a specific period of years. Several delayed annuities enable you to annuitize your agreement after the very first agreement year. A significant distinction is in the tax therapy of these items. Passion gained on CDs is taxable at the end of yearly (unless the CD is held within tax obligation professional account like an IRA).

Additionally, the rate of interest is not exhausted till it is removed from the annuity. Simply put, your annuity expands tax deferred and the passion is compounded yearly. Nonetheless, window shopping is always a good concept. It holds true that CDs are insured by the FDIC. MYGAs are insured by the private states usually, in the array of $100,000 to $500,000.

Usaa Annuities

Either you take your money in a lump amount, reinvest it in an additional annuity, or you can annuitize your agreement, transforming the lump amount right into a stream of income. By annuitizing, you will just pay tax obligations on the rate of interest you obtain in each payment.

These attributes can vary from company-to-company, so make certain to explore your annuity's death advantage functions. There are several benefits. 1. A MYGA can imply reduced tax obligations than a CD. With a CD, the passion you gain is taxable when you make it, although you do not get it until the CD develops.

Not just that, however the worsening passion will certainly be based on a quantity that has actually not already been exhausted. Your beneficiaries will certainly receive the complete account worth as of the date you dieand no abandonment fees will be subtracted.

Your recipients can choose either to get the payment in a lump amount, or in a series of income repayments. 3. Usually, when a person dies, also if he left a will, a judge chooses who obtains what from the estate as often family members will certainly say about what the will certainly ways.

With a multi-year fixed annuity, the owner has actually plainly marked a beneficiary, so no probate is needed. If you contribute to an IRA or a 401(k) strategy, you obtain tax deferral on the profits, just like a MYGA.

Table of Contents

Latest Posts

Immediate Life Annuities

Annuity Comparison Chart

Challenger Annuities

More

Latest Posts

Immediate Life Annuities

Annuity Comparison Chart

Challenger Annuities